What Are Closing Costs?

First time home buyers…this ones for YOU! Must read!

What are closing costs? What should I know before getting my next loan?

What Are Closing Costs?

Closing costs are fees paid in connection with the refinance or transfer of ownership in real property. They are paid by either the buyer or the seller on the settlement date.

These fees will always vary. What you pay for one refinance or property transfer will not be the same as another. This is due to the different parties involved, different types and locations of property, the financial capacity of a buyer and many more factors.

The law requires lenders to give you a loan estimate within three days of receiving your application. This document sets out what your closing costs will be. These fees, however, are not set in stone and subject to change.

Your lender should provide a closing disclosure statement at least three business days before the closing date. This is a more reliable estimate of your closing costs. Compare it to the loan estimate you’ve received and ask your lender to explain the fees and the reasons for any changes.

What Is Included in Closing Costs?

Your costs will differ depending upon the transaction. Types of costs include:

- Credit report fees (the cost of checking your credit record)

- Loan origination fees (which consists of the cost to your lender for processing your loan)

- Attorney fees

- Inspection fees (for inspections requested by either you or the lender)

- Appraisal fee

- Survey fee (so that both you and the lender know where your property boundaries lie)

- Escrow deposit which may cover private mortgage insurance and some property taxes

- Pest inspection fee

- Recording fee paid to a county or city authority to file a record of the property transfer and/or new mortgage lien against the property

- Underwriting fee to cover the cost of processing a loan application

- Discount points (money you pay your lender to get a lower interest rate)

- Title insurance (protection for you and the lender should there be any issues with title to the property)

- Title search fees (costs incurred by the company who checks the title on the property)

These fees can range anywhere from 2% to 5% of a property’s selling price. It’s smart to get estimates from two or three lenders so that you can take these costs into consideration before making an offer. For the easiest way to compare lenders who may use different terminology to describe their fees, simply ask for a loan estimate from each.

Can I Negotiate These Costs?

Some fees, such as document, processing, service, underwriting and courier charges are open to negotiation. However, third party fees such as an appraisal or survey, are not.

If you’re worried about how much you’ll need at closing you can find a bank that doesn’t escrow real estate and homeowners insurance. Often, banks will escrow six months of real estate taxes and several months of homeowners insurance premiums. When added to the other closing costs, this can be quite a large sum.

Keep in mind, however, that you will be responsible for paying your homeowners insurance and property taxes when they’re due rather than relying on your lender to pay them for you.

Where allowed by law, you can negotiate with the seller to have them pay some closing costs normally attributed to the buyer.

Can I Add my Closing Costs to the Loan?

Most loan programs will allow for a percentage of the purchase price to go towards closing costs. The easiest way to do this is to ask for a seller credit towards the closing costs.

The seller credit means that the seller will receive a smaller ‘net’ amount at closing, however there is a way to make a seller credit more palatable to the seller. If you can qualify for a higher purchase price – say 2.5% over list – the seller won’t lose any money and you can use the seller credit towards the closing costs.

In this scenario, what you’re doing is financing your closing costs over the life of the loan.

You can also do a lender credit. Like a no-cost refinance, you agree to a higher interest rate so that the lender will pay some of the closing costs. You can potentially get a lender credit of $2,000 to $4,000 – a sizeable amount of fees.

Keep in mind, however, that should you continue paying the same mortgage over the life of the loan, you could end paying more than if you were to pay up front.

What Can I Expect?

Before closing day arrives, contact your agent to confirm that he or she has everything for the transaction to go as smoothly as possible. Pull together any paperwork that you have received and keep it on hand for easy reference on closing day.

Be prepared to take your time reading through all of the closing documents. Make sure you completely understand all of the terms you’re agreeing to. If some of the terms are missing or incomplete, don’t sign until they are resolved to your satisfaction.

Your lender will send money to the closing agent via a wire transfer and may require that you set up a new escrow account with them to pay your property taxes and homeowners insurance together with your monthly mortgage payment.

You should be advised before closing day how much money you’ll need to have for closing, so bring your checkbook with you to cover any necessary escrow and/or closing costs.

Among the many documents you’ll be signing, three of the most important documents will be the:

- Hud-1 Settlement Statement – a document which sets out the costs incurred with your closing.

- Deed of Trust or Mortgage – a document in which you agree to a lien being placed against your property as security for repayment of your loan.

- Promissory Note – a document which can be described as a legal “IOU” which sets out your promise to pay according to the terms of the agreement.

Source: CB Blue Matter

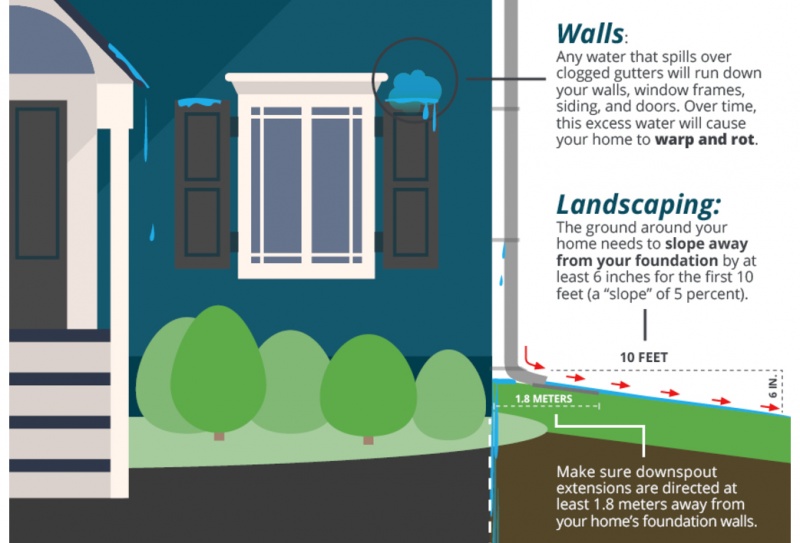

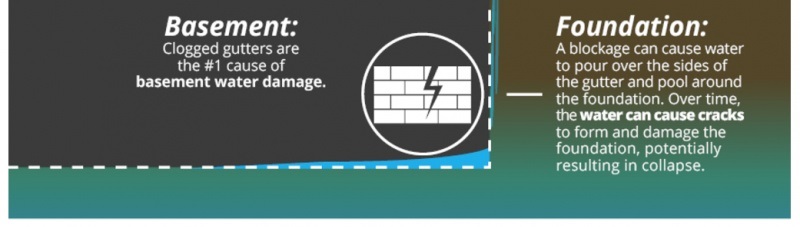

Don’t Let Clogged Gutters Wreak Havoc on Your Home

Deferred maintenance on your gutters can cost you dearly. It’s almost as bad as having no gutters!

As a homeowner, you undoubtedly understand just how important home maintenance is when it comes to preserving the life of your home. In fact, you probably spend a good chunk of time fixing problem areas and items both inside and outside your home.

But when was the last time you checked the gutters? While clogged gutters can wreak havoc on your home from top to bottom, maintaining your gutters and downspouts will work in your favor when it comes to avoiding conditions such as flooding, foundation damage, pest infestation, roof damage, warped/rotted window frames, siding and doors, and mold—all of which may ultimately undermine the integrity of your home.

The following infographic from Kings of Clean sheds light on the important role gutters play in the well-being of your home.

Source: RisMedia

How to Prepare Your Home Before Going on Vacation

Ahhhhh, that summer vacation is on your radar now…just a few loose ends to wrap up before you hit the road!

Your summer vacation is finally here! You’ve booked flights, reserved hotel rooms, and scoped out the best places to eat along the way, but have you prepared your home for your absence?

Nothing spoils a vacation like returning to smelly trash, sad houseplants, or an unexpected break-in. Whether you plan to be gone for a week or a month, there are a few simple steps you can take to get your home ready so you can relax and enjoy your time away.

Clean Up

Leave your home exactly as you’d like to find it when you return—like new!

- Empty your refrigerator of any perishable foods that will pass their enjoy-by dates while you are away, and toss open pantry items that will mold or go stale.

- Take out the trash and recycling. Don’t forget about smaller trash cans in bathrooms and utility rooms.

- Finish, fold, and put away laundry. You’ll likely have clothes to wash when you return, so get a jumpstart before you go.

- Wash your sheets and towels, and remake your beds. You’ll thank your past self when you come home to fresh linens in clean bedrooms and bathrooms.

- Wipe down counters, run your garbage disposal, sanitize toilets, and organize clutter.

Close Out

Reduce the possibility of surprise maintenance issues, which can be costly to fix, by keeping up with regular home repairs throughout the year.

- Perform routine inspections and weatherize. Make sure your heating and cooling systems, gas and water lines, and roof and windows are in good shape. Clean up your yard, mow the grass, and take care of any dead trees or overhanging limbs that could cause damage in severe weather.

- Unplug all small appliances. This will save power and eliminate the potential for things to short-circuit and cause significant electrical damage.

- Check your smoke detectors. Batteries die, parts wear out, and dust and other pollutants can impede alarm performance. Make sure your home is prepared in case of fire, and consider integrating your detectors into your home security system so the fire department is notified in an emergency.

- Turn off your water at the main shut-off valve to prevent damage in the case of a burst pipe or water heater malfunction. Consider installing a water and flood sensor, which detects moisture where it shouldn’t be and pushes notifications to your smartphone.

- Leave your closet doors ajar to prevent mold and musty smells from building up.

Secure

Protect your home and belongings from thieves. The highest percentage of burglaries occur during the summer months, and homes without security or alarm systems are up to 300 percent more likely to be broken into.

- Set up remote monitoring. You can have a security system professionally installed or start with a wireless security camera that you can view from your smartphone. If you have a security monitoring service, let them know that you are traveling.

- Collect spare keys. If you have house keys hiding under doormats or flower pots, bring them inside so prowlers don’t find them. Leave an extra set with a trusted neighbor or friend in case there’s an issue that needs to be addressed while you’re away.

- Hold your mail and newspapers. Nothing signals that you are out of town like an overflowing mailbox or stack of unread papers on your front porch. Placing a hold with USPS is as easy as completing an online form and will prevent identity thieves from targeting sensitive information found in bills and credit card statements.

- Take advantage of home automation. You can link everything from smart locks that you can triple-check via smartphone app to smart doorbell cameras that sense motion on your front porch and have two-way audio.

- Close blinds into rooms that contain expensive items, and set up smart light timers that mirror your regular habits when you’re home.

- Ask for help. Have a neighbor park in your driveway while you’re gone, and enlist a friend to water your plants and check up periodically on your property.

A little bit of preparation will go a long way when it comes to leaving your home clean and secure, and enjoying your vacation stress-free!

Source: RisMedia

CBKG’s Guide to Best Ever 4th of July Family Fun Events!!!

Come check out CBKG’s guide to the BEST 4th of July Celebrations in our area.

Lots of fun to had here people! Let’s Get out there and Celebrate!

|

Suisun City Independence Day Spectacular

|

Picnic in the Park and Fireworks Where: Benicia, Benicia City Park When: July 4, noon – 7 p.m., Fireworks at 9 p.m. >> Details |

|

Six Flags Discovery Harbor July 4th Fest

|

Vacaville 4th of July Fireworks & Creekside Concert Where: Vacaville, Andrews Park When: July 4, 6:30 p.m., Fireworks at dusk >> Details |

|

Fairfield Independence Day Parade

|

Napa County Fair & Fireworks Where: Calistoga, Napa County Fairgrounds When: July 4, 11:00 a.m. – 10:00 p.m., Parade at 11:00 a.m. Fireworks at 9:30 p.m. >> Details |

|

Watch A’s Fireworks From the Field

|

Celebrate Concord 4th of July Where: Downtown Concord, Todos Santos Plaza When: July 4, 8 a.m. – 10 p.m.; 5K/Kids run at 8 a.m., parade at 10 a.m., festival at 4 p.m. and fireworks at 9 p.m. >> Details |

|

Alameda County Fair 4th of July Fireworks Spectacular

|

Vallejo 4th of July Parade Where: Vallejo, Downtown Vallejo When: July 4, 12:00 a.m. >> Details |

|

American Canyon 4th of July Festivities

|

Dixon’s Family 4th of July in Hall Park Where: Dixon, Hall Park When: July 4, 8:00 p.m., Fireworks at dusk >> Details |

|

Antioch’s An Old Fashioned Hometown 4th of July |

West Sacramento Fourth on the Field Where: West Sacramento, Rayley Field When: July 4, 6:00 p.m. – 10:00 p.m.. >> Details |

|

Pleasant Hill Fourth of July Celebration

|

Napa 4th of July Festival & Fireworks Where: Napa, Downtown Napa & Oxbow Commons & Veterans Park When: July 4, 10:00 a.m. – 10:00 p.m. Parade at 10:00 a.m., Festival at 1:00 p.m., Fireworks at 9:30 p.m. >> Details |

|

Folsom Pro Rodeo

|

Sacramento Independence Day Celebration Where: Sacramento, Cal Expo When: July 4, 5:00 p.m. – 10:00 p.m. Gates open at 5:00 p.m., Fireworks at 9:30 p.m. >> Details |

|

|

11 Reasons Why Your Home Isn’t Selling

Your home is on the market and you really thought it would go into contract that first month, but it didn’t. Its not. No offers. Nada.

What’s up with that? Read on!

When you first put your house on the market, you might be hopeful for a quick sale—especially if you’ve put a lot of money into improving the house over the years and if the neighborhood is one that has historically attracted a lot of buyers. While you shouldn’t panic if the house doesn’t sell the moment you list it, you should begin to worry if the months start flying by without any real offers. If this is the case, here are 11 reasons why your house may not be selling.

1. You overvalued your property. If your house is overpriced, it’s simply not going to sell. Compare your property to similar properties that recently sold within your area to get a better idea of its true value. An experienced real estate agent can give you an accurate value of your home. Additionally, don’t make the mistake of tacking on the cost of any renovations you made. You can’t just assume that the cost of a renovation translates to added value.

2. Your listing is poor. If the listing of your home includes a poorly written description without any images, a lot of buyers are going to skip over it. Make sure you and your REALTOR® put an effort into creating a listing that attracts the attention of buyers. Make sure to add high quality photographs of both the interior and exterior of your home. Don’t forget to highlight unique features, as well.

3. You’re always present at showings. Let your agent handle your showings. Buyers don’t want to have the seller lurking over their shoulder during showings, especially during an open house. This puts unwanted pressure on the buyer, which will make them uncomfortable and likely chase them away.

4. You’re too attached. If you refuse to negotiate even a penny off your price, then there’s a good chance that you’ve become too attached to your home. If a part of you doesn’t want to sell it, or you think your house is the best house in the world, odds are you’re going to have a lot of difficulties coming to an agreement with a potential buyer.

5. You haven’t had your home professionally cleaned. A dirty house is going to leave a bad impression on buyers. Make sure you have a professional clean your carpeting and windows before you begin showing your house.

6. You haven’t staged your home. If you’ve already moved out, then don’t show an empty house. This makes it difficult for buyers to imagine living in it. Stage your house with furniture and decor to give buyers a better idea of how big every room is and how it can be used. You want the buyer to feel at home when they are taking the tour.

7. You kept up all of your personal decor. Buyers are going to feel uncomfortable touring your house if you keep all of your family portraits up. Take down your personal decor so that buyers can have an easier time imagining themselves living there.

8. Your home improvements are too personalized. You might think that the comic book mural you painted for your child’s room is absolutely incredible, but that doesn’t mean potential buyers will agree. If your home improvements are too personalized, it can scare off buyers who don’t want to pay for features they don’t want.

9. Your home is too cluttered. Even if your home is clean, clutter can still be an issue. For example, maybe you simply have too much furniture in one of your rooms. This can make the house feel smaller than it is.

10. Your home is in need of too many repairs. The more repairs that are needed, the less likely a buyer will want your house. Many buyers simply don’t want to deal with the cost or effort of doing repair work, even if it’s just a bunch of small repairs, such as tightening a handrail or replacing a broken tile.

11. You chose the wrong real estate agent. In our opinion, choosing the right real estate agent is simply the most important decision you make in selling your home. A good REALTOR® makes all the difference in selling your home within a reasonable time.

All these things can be fixed once you realize your mistake; however, the longer your property stays on the market, the less likely it will sell at listing price. One of the best ways to avoid making these common mistakes is by working with a professional real estate agent.

Source: RisMedia

5 Things to Know About No-Interest Credit Cards

If you have been contemplating getting one of these, then this article is a must read!

Tempted by that offer for a new credit card with an interest-free grace period? Don’t succumb to the first attractive zero percent interest credit card offer that comes your way—unless it’s the right card for you.

First, come to understand your own motivations. A credit card with a no-interest introductory offer may be a good choice if you’re looking to consolidate debt through a balance transfer or if you’re contemplating a vacation or big purchase but don’t have the cash to immediately pay for it. Then, compare the terms of the cards you’re considering. Doing so can help you avoid potential pitfalls and choose the best offer for your circumstances.

Before you take the zero percent plunge, consider these five tips to make sure your decision is the right one.

Look Beyond the Offer

Zero percent interest cards offer a free promotional period on purchases, balance transfers, or both for a set time, typically anywhere from 12 to 21 months. After that teaser period, the card’s standard annual percentage rate will kick in.

Examine that go-to rate closely.

If the standard APR is higher than the rate you’re charged on your current cards—and you even occasionally carry a balance—it probably doesn’t make sense to use the new card after the intro period expires.

Some zero percent interest cards double as a rewards credit card and charge an annual fee. Make sure you’ll be able to take advantage of the rewards you’ll get in return for paying that fee. Otherwise, move on to another card.

Although it’s possible to close the card after the promotional period is over, it’s not recommended. Like all credit card applications, before you’re approved, the issuer will do a “hard” credit check, which can adversely impact your score. And every time you close an account, you reduce your available credit, which can also ding your credit rating.

Have a Plan

The best way to take advantage of a zero percent credit card is to pay down a huge debt transferred from an existing credit card during the introductory period.

Use that interest-free time to pay off your debt entirely (or reduce it substantially) before the intro rate expires and you begin paying interest, possibly at a higher rate than your original card. Paying the maximum monthly amount you can afford, without accruing interest, can give you a leg up on wiping it out completely.

A balance transfer calculator can help you determine how much you’ll have to pay each month to retire the debt before the end of the introductory period.

“A balance transfer is just the first step in a two-step process,” says Greg McBride, CFA, Bankrate’s chief financial analyst. “The second—and more important—step is to use that lower rate to accelerate debt repayment and get the balance paid off for good. Otherwise, you’re just moving money around.”

Even if you can’t pay the debt in full by the end of the intro period, always make sure to pay on time. A late payment could void the promotional period, possibly trigger a penalty APR and cost you a princely sum in late fees.

Mind the Fees

Don’t be fooled: When it comes to balance transfers, a zero percent offer doesn’t mean you’ll be able to pay off your debt for free.

Balance transfer offers typically come with a one-time fee that ranges from 3 to 5 percent of the amount being transferred, although there are cards that charge no fee. Most of the time the math will work in your favor, even if you’re moving a substantial sum to a new card, but it’s smart to ensure that what you’ll save on interest payments is greater than the upfront fee.

Let’s say you want to transfer $5,000 to a card that charges no interest for 12 months. If the card charges a 3 percent transfer fee, you’d pay $150 to move the balance to a new card. Use a calculator to determine what you’d pay in interest on your current card over the course of the intro period.

Even if you have a cheap zero percent APR on your current card, your interest payments during that year would be much higher than the transfer fee—even assuming you paid off your entire balance.

Alternately, you may find that the best balance transfer credit card for you is one with a shorter promotional period but doesn’t charge a balance transfer fee. In some cases, it may be a better option than a card with longer terms that has a hefty upfront charge.

Beware the Purchase APR Pitfall

It might be tempting to splurge a little with a new card—especially if you won’t get charged interest on new purchases for a year or longer. Spending beyond your means is how debt accrues in the first place, and even an interest-free purchase still has to be paid for.

So, if you get a zero percent credit card to help manage your debt, be cautious about spending.

“Don’t get too enamored with the zero percent on new purchases,” says John Ulzheimer, a nationally recognized credit expert formerly with FICO and Experian. “Make purchases you normally would have made anyway like dry cleaning, gas, groceries—and pay it off so you don’t get into more debt.”

If you carry no credit card debt and want the card to finance a big purchase that’s beyond your monthly budget, like an appliance or furniture, proceed with caution, as well. Do this only if you can pay off the purchase during the intro period.

Make Sure You Qualify

Like most of the best credit card offers available, the better your credit score, the more likely you are to qualify for a great offer on a balance transfer card.

“Because of the structure of the cards, they’re really reserved for people with great credit. Even though you may want one, you may not qualify,” says Ulzheimer.

Overall, issuers rejected 17.7 percent of credit card applications between October 2016 and February 2017, according to a survey by the Federal Reserve Bank of New York.

Even if you are armed with a high enough credit score to qualify for the best offers, in some cases, there may be a cap on the balance transfer amount. Check the fine print to see if the balance transfer card will meet your needs before applying.

“Your balance may be (so) large that the new issuer won’t accept it,” says Linda Sherry, director of National Priorities at watchdog group Consumer Action.

Source: RisMedia

9 Home Gadgets to Save Energy and Entertain

Who doesn’t love a great gadget?! Isn’t it interesting what sort of great ideas these companies come up with?

So you’re up for making your home truly state-of-the-art? I’ve got a great list for you. Here are nine gadgets to be on the lookout for:

Moen’s U lets you customize the perfect shower before ever stepping in with just a few taps on your smartphone.

Smart and Blue’s Hydrao smart showerheads let you instantly control your water consumption and energy needed to heat it by lighting up the water spray with different colors depending on the amount of water used—and it’s powered by the shower’s natural water-flow.

Luke Roberts Smart Light – This LED pendant lamp, from Austrian startup Luke Roberts, lets you place light in any direction, illuminating only certain areas of a room through simple gestures on your phone.

Kuri – Created by Mayfield Robotics, this app uses a camera to check on pets, kids, or guests when you’re away. It sets reminders, uses Wi-Fi to connect to things like weather reports, and works with IFTTT to control some connected devices, according to CNET.com.

Hello Egg – From RnD64, this works with the Eggspert web and mobile application to fully automate planning weekly meals, supervising the pantry, organizing shopping lists, and even ordering grocery delivery. Hello Egg also projects voice-navigated video recipes and answers cooking-related questions with a connected 24/7 support team of cooking experts.

CUJO creates a guarded firewall gateway between your devices and their connection to the internet by analyzing for malicious intent, whether it’s coming in from the internet, going out to the internet, or making moves across your network.

AirTV is the only major streaming platform that integrates local over-the-air (OTA) programming with your streaming services. Just add an AirTV Adapter and an OTA antenna to get local channels in HD, without a monthly cable bill.

Sony A1E – Unlike most TV speakers, sound comes to you from the entire screen, immersing you in a new entertainment experience—if there can be such a thing!

LG W7 – Capturing Best of the Best recognition at CES 2017, the W7’s picture-on-wall design allows the television to lay virtually flat so it seems blend with the wall and disappear.

Source: RisMedia

6 Easy DIY Projects That Will Boost Your Home’s Value

Not only will these DIY’s boost your home’s value, but you get to enjoy them too.

The satisfaction of creating something productive is powerful!

Your house is likely to be the biggest investment you make in your entire life. Whether you’re planning to sell it or you’re there for the long haul, it is important to take care of your investment. As any real estate agent will tell you, the first thing people notice about your home is the exterior. You need strong curb appeal to make a good first impression.

With that in mind, here are six simple DIY projects to help boost your home’s value:

Invest in Your Landscaping

Landscaping is often regarded as one of the top three ways to add value to your home in terms of return on investment. HomeGain.com conducted a survey of 2,000 brokers in 2007. The results indicated you could possibly quadruple an investment of $400-$500 on well-planned landscaping.

That said, just throwing a couple hundred dollars at plants is not a good approach. Instead, focus on creating a healthy, vibrant lawn. Fill in dead or sparse areas, fertilize, and clean up edges along your sidewalk, pathways and gardens. Trim overgrown bushes and shrubberies and cut down tangled tree branches. Plant flowers and plants to brighten up your landscape—just be sure to plant perennials that will come back year after year, not annuals that will die within a year and never return. Also, look for plants that are native to your region or are drought-tolerant. They need less water and maintenance, saving you money in the long run.

Upgrade Your Front Door

Your front door is the entryway to your home and it sets the tone for the rest of the house. Make a good impression by ensuring your home’s entry point (including the area directly surrounding the door) is attractive and eye-catching.

The first thing to consider here is whether to replace your existing door or not. If the door you have is good quality and a style you like, you can save some money by just freshening it up a bit. Refinish the wood or paint it for a pop of color; clean and polish the hardware or replace it with something that will add more of an accent; and replace the hinges if they are worn. If you decide to replace the door, look for a well-insulated, energy-efficient, secure door; this is not something you want to cut corners on by going with a cheap alternative.

Illuminate With Outdoor Lighting

Outdoor/exterior lighting adds value to your home in three important ways. First, it helps keep you and your family safe. It’s important to be able to see where you are going to avoid a fall. Second, it adds a layer of security. Keeping your property well-lit is a good way to deter a would-be thief from targeting your home. Third, it enhances the aesthetics of your property. Show off your beautiful home and well-maintained landscape.

Consider which of these aspects are important to you. If safety is your goal, focus on pathways, entryways and steps. If you are more concerned with security, perimeter lighting set on timers and motion-activated flood lights are your best bet. If you want to add curb appeal, light up your trees, unique landscape elements, and water features.

The second thing to consider is what type of lighting to go with. Solar is great because you don’t need wiring and don’t have to pay for power. LED lights produce a bright, crisp light and are energy-efficient. Halogen lighting, though affordable, is being phased out for the most part. Consider replacing existing halogen bulbs with LED replacements (also called LED retrofitting).

Discover the Magic of Pressure Washing

You see your home every day, so you might not notice as it slowly gets dirty and the colors and features become dusty and dim. Just spending an afternoon with the power washer can dramatically add some pop and resuscitate your curb appeal.

First and foremost, read the instructions and specifications of the pressure washer you purchased or rented. Check the water flow in gallons per minute in addition to the PSI, and get one with different pressure settings if possible. Confirm it is okay to use on all the areas you are planning to wash to ensure nothing will be damaged. You’ll probably be okay on things like sidewalks and driveways, but double check that your siding and windows can withstand the pressure. Turn off power to electrical outlets and fixtures and cover them. You may also want to cover plants and flowers if they are close to your house or the area you’ll be cleaning. You’ll likely want to use detergent (only use detergent that is specifically made for pressure washers) for the grimier parts of the job.

Create a Beautiful, Functional Space With a Fire Pit

Adding a fire pit is a cheap, simple way to help get the most out of your outdoor space by breaking it up into different areas. Fire pits consistently poll well among potential homebuyers (especially younger ones), and came in first in expected popularity of design elements, according to the Residential Landscape Architecture Trends Survey. One of the great things about taking on this project is that it can be as simple or as grand as you like. You could DIY a very basic one for as little as $150, or you could go all out and include a gas line (with professional help) and a fancy fixture if you have a bigger budget at your disposal. If you are not as handy, you can get a kit with everything you need and step-by-step instructions. However, building your own fire pit is not overly complicated and will allow you to completely customize it to fit your personal taste.

Upgrade Your Home’s Technology

These days, homebuyers want the latest technology. It’s easy to understand why when you look at all the amazing things technology can do for your household. Having these advanced features can be what sets your home apart from similar ones on the market.

You can install smart locks for added safety and convenience. You’ll never have to stumble around trying to get your keys out of your pocket while carrying groceries again, thanks to Bluetooth technology that will pick up on your phone approaching—and you’ll never stress again wondering if you forgot to lock the door when you rushed out. Smart sprinklers can save time and money. The sprinkler system can adjust based on weather patterns and temperature so you’ll save money by not wasting water.

These are all projects that offer a good return on your investment and can be done without a professional, saving you around 40-60 percent of what you might be charged. Plus, these projects can be wrapped up within a couple days, meaning you could conquer them over the course of a weekend or two. Get out there and start building some sweat equity the smart way!

Source: RisMedia

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link