8 DIY Projects That (Surprise!) Require Permits

Your insurance company won’t be on your side if something goes awry with your renovation and you don’t have a permit.

“Eh, we’ll just knock it out this weekend, not going to worry about the permit”… not so fast there partner. No shooting from the hip here! You can not only get into trouble with your insurance company and the local building department, but when it comes time for you to sell? You better have that permit in hand for these DYI improvements.

You might roll your eyes at having to get a permit before doing a DIY project around the house, but permits serve a purpose.

Permit requirements are just ways for the city to nickel-and-dime you to death, right? Is your city invading your privacy by caring whether you want to replace your overhead light fixture with a ceiling fan?

Before you get too worked up, realize that cities have their reasons for requiring permits. “Obtaining a permit means that someone knowledgeable will review your plans and help spot mistakes before you begin the work,” says Rick Goldstein, an architect and co-owner of MOSAIC Group in Atlanta, GA. If you make improvements without a permit, you might receive a big, fat denial letter from your insurance company when something goes wrong and you want to cash in.

You know the phrase “You don’t know what you don’t know”? Well, that’s the way it is with permits. That ceiling fan might be too heavy to hang from a box designed for a simple light fixture, especially when it’s going full blast and vibrating. You don’t want the fan falling on you while you sleep!

You might know some projects that require a permit, but you might be surprised by these eight DIY projects that typically require a permit too.

-

Installing a gas stove

Many people are making the switch from an electric to a gas stove. Depending on where you live, gas could be much cheaper, and if you’re a foodie, food just tastes better cooked over fire. But if installed incorrectly and the gas leaks, it could be extremely harmful. Get a permit and make sure someone is checking behind you to catch any mistakes.

-

Replacing windows or doors

If you think this project seems pretty straightforward, think again. For windows, you need a permit to ensure emergency egress requirements are met in case first responders need to get in. If windows and doors aren’t properly installed, water could get into the house. No one wants a side of mold with their renovations.

-

Building a deck

When dreams of outdoor living beckon, first call the permit office. If your deck isn’t structurally sound, or if you used untreated lumber that decays, your deck could collapse, and that could really interfere with your meditation mantra. And don’t even try to guess how to meet building codes for railings. Be safe and get that permit.

-

Putting up a fence

“Building a fence requires a survey and a permit,” Goldstein says. The reason for this is usually to ensure you aren’t violating city ordinances by building a fence too high in your residential subdivision or choosing one with barbed wire in the middle of the city. If you build a fence without a permit, you might receive a stop-work order.

-

Installing a storm shelter or safe room

If you want protection from tornadoes (and hurricanes), you might consider installing a shelter. But unless you design and construct this room to FEMA specs, you might not be so safe after all. A huge benefit of a prebuilding permit is that you can register it. “If there is a tornado in your area, first responders will know who has storm shelters and where they need to look for you in case you get trapped inside,” says Blake Lee of F5 Storm Shelters in Tulsa, OK.

-

Remodeling a kitchen or bathroom

Picking out the perfect granite for your countertops and finding just the right fixtures and cabinetry aren’t the only things on your checklist. If you neglect to get a permit for major remodeling work, you might not be able to easily sell your home in the future.

“If an inspector catches this kind of thing, or if a bank wants to make sure it’s covered against all liability and demands to see the permit before funding a mortgage, this can potentially be a major time and money sink to rectify,” says Kimberly Wingfield, a Philadelphia, PA, real estate agent and DIY fanatic.

-

Installing new electrical wiring

Your house in the historic district simply isn’t wired for all your gadgets — but an amateur electrical wiring job could cause a fire. This project definitely needs a permit.

-

Replacing a gas water heater

Surely you can replace your old water heater without a permit, right? Nope. Although many DIY enthusiasts do it all the time, if it’s done wrong, a fire or flood could ensue, or if gas escapes …kaboom. These risks leave a huge potential for serious injury. A permit also means that an inspector looks over your completed job to ensure it was done properly. This is a huge confidence boost in the knowledge that your work is up to code — and minimizes the potential for home-sale complications down the road.

Source: Trullia Blog

Pool School: A Study Guide

Armed with a little know how – you can make your pool season trouble free!

1. Evaluate the Task at Hand

Always check for leaks at the start of the season—all you need is a bucket. Just fill it three-fourths of the way full and mark the water line inside, place it in the pool, mark the line on the outside and let it float for a couple days. If the water goes down the same amount inside and out, it is from evaporation, but if it goes down more on the outside, there is a leak and you’ll need to call a pro.

2. Keep It Clean

- Skim Debris – If you have trees, bushes or other plants nearby, the wind can blow debris into the pool. To keep it clean, increase the water circulation and use fewer chemicals, and use a skimmer to scoop out the debris out on a weekly basis.

- Vacuum Frequently – Not all debris floats on top, so to get the hard-to-reach debris, you should vacuum the pool on a weekly basis for about half an hour. You can always buy an automated vacuum that runs on a schedule, so you don’t have to worry about it.

- Filter and Pump – To keep water clean and save energy, run the pump daily for every 10 degrees (e.g., if it’s 80 degrees outside, run the pool pump for eight hours). Keep water healthy and clear by cleaning the filter every other week. Simply empty the filter bag or remove the filter and hose it down. If the pump is unusually loud, leaking or doesn’t hold pressure, it’s time to call a professional. If you have a home warranty with pool coverage, you’ll also save time and energy not having to find a qualified service professional yourself.

3. Get an A in Chemical Chemistry

Test water levels weekly with a home pool water test kit to make sure chemicals are balanced and safe. Optimal chemical levels vary depending on the season and weather conditions, but the pool’s pH levels should fall between 7.2 and 7.8 consistently for the cleanest water. This will also help protect your pool equipment. Water becomes more acidic with lower pH levels, which can cause costly damage to your pump, filter and anything else that it comes in contact with.

Source: RisMedia

2017’s Most Important Summer Home Maintenance Projects

These projects are what you should be focusing on this summer regarding maintenance on your home.

Being proactive when it comes to your home’s maintenance can save you time and money! Focus on maintaining these 5 areas.

With the bright sunlight and warm temperatures that accompany summer, you may be spending more time outside — and you may be noticing areas of your home’s exterior that need repair. But there’s more reason to tackle your home maintenance projects this summer than simply cosmetic appearance. Maintaining your home will prevent major leaks and damage that may eventually require professional help, usually when its most expensive and inconvenient for you.

Being proactive when it comes to your home’s maintenance can save you time and money, and it makes sense to do it when you’re more likely to be outdoors in the comfortable summer months. Here are five areas of your house that are most important to keep updated.

-

Windows

Start by cleaning the exterior of your windows with hot soapy water and a sponge or squeegee. If you’ll need a ladder, make sure to review safety guidelines.

While you’re washing, inspect each window pane for cracks. Double or triple glazed windows with damaged seals or cracks may need to be replaced. Think back: Have your windows had excessive condensation inside through the winter and spring? That’s another sign that the seal might have been compromised and that your window might need to be replaced.

You’ll also want to inspect caulking and weatherstripping around your windows. Recaulk any spots where the caulk is loose or chipping away, or consider applying new caulk for a tight seal. Summer is a perfect time to do this because the warm temperatures and low humidity will help the caulk set perfectly.

Finally, wash window screens and replace any screens that have rips or holes.

-

Roof

Visually inspect your roof every summer for missing or broken shingles, shakes and panels. Again, if you’ll be using a ladder and climbing up to your roof, make sure you follow safety guidelines. If you have any concerns about using a ladder or moving around on your roof, or if you’re unsteady on your feet, call your roofing company. Most roofers will make inspections and do basic maintenance for you.

While you’re up on your roof, you’ll also want to check flashing and seals around vents, chimneys and skylights. Apply caulk around any areas that haven’t been re-sealed in the past year.

Algae and moss can plague even new and well-maintained roofs. Apply a moss killer designed for roofs or install zinc strips that can help keep algae and moss from taking hold.

Your gutters should be cleaned and checked for holes or other damage. Look for water stains around your gutters and downspouts that indicate a problem.

-

Exterior

Check high and low over your exterior and look for holes, gaps and cracks in your siding. It’s less expensive to replace siding that is just starting to deteriorate than to wait until it’s broken down completely and impacted your home’s structure, insulation and inside walls.

While you’re walking around your home, look for any signs of pests. Termites and carpenter ants can be devastating to your home’s structure, while ants and wasps can be a nuisance and cause minor damage to your home’s exterior. Check vents and crawl-space access doors to make sure rodents and other wildlife can’t get in.

-

Foundation

Check your foundation for any cracks and signs that there has been a leak, such as water stains. Any small cracks can be repaired, but larger cracks should be inspected by a pro. Once you repair small cracks, re-seal the foundation with a good waterproof masonry sealer.

Pull out any larger plants growing close to your home that might impact the foundation. Besides the risks of roots growing into your foundation, watering plants close to your home can cause water to pool around the foundation and lead to damage.

-

Heating and Cooling

You’re going to want to make sure your air conditioning is ready for the heat ahead, so replace filters and remove and clean your unit’s fan and condenser. Make sure you turn off power to the unit before you tackle any work.

At the same time, your furnace should be checked and readied for use again at summer’s end. Vacuum out the burner and blower cavities, and vacuum and brush the blower blades. Change the filter so the furnace is all ready to go when it’s time to turn it on again.

Your home is a big investment, and it’s important to keep it in good “health.” Spend some of your summer days inspecting and making minor repairs and you’ll reduce your chances of needing a big repair later.

Source: CB Blue Matter

6 Flood Insurance Myths Debunked

If you live in a designated flood zone that requires flood insurance, then you need to understand your policy. What is covered and (more importantly!) what is NOT!

If a flood swamps your home, will insurance cover the damage?

That depends on the value of your home, the amount of water damage and whether you have a flood insurance policy.

Regular home insurance doesn’t cover flooding. You’ll need a policy offered through the government’s National Flood Insurance Program (NFIP)—but note that those top out at $350,000 in coverage for your home and its contents. For higher amounts, you may need supplemental coverage to protect your savings from taking a hit.

People tend to associate floods with a total loss, but the average flood claim for U.S. homeowners is about $39,000, according to the NFIP.

Here are six other persistent myths about flood insurance—and the truths you need to know.

To Get a Policy, You Must Live in a Flood Plain

Not true. If you live in a flood plain, your mortgage company will likely require you to buy flood insurance, but you can purchase it even if you don’t live within a flood zone.

“Almost anybody can get flood insurance who wants flood insurance,” says Chris Hackett, director of Personal Lines for the Property Casualty Insurers Association of America.

The price through the federal flood insurance program is based on standardized rates and depends on the home’s value and whether or not it’s in a flood plain, says Don Griffin, vice president of Personal Lines for the Property Casualty Insurers Association of America.

The average price for flood insurance is about $660 annually. Your agent can help you buy a policy and may accept payment by credit card.

According to Griffin, one in four flood claims is for a home not in a flood plain.

Flood Insurance Is Just for High-Risk Areas

Merle Scheiber’s dream home wasn’t in a flood plain, and he didn’t have flood insurance.

Just after completing a three-year renovation project for his 1,800-square-foot, cabin-style home, flooding put it underwater for almost four months.

Scheiber, who happened to be South Dakota’s director of Insurance at the time, says he had to tear the home apart and put it back together all over again.

He urges that all homeowners—even those who do not live in designated flood plains—weigh the dangers and their options and seriously consider buying flood insurance.

Flood Insurance Covers Everything

Not necessarily. When it comes to the physical structure of your house, federal flood insurance policies top out at $250,000. If you have a $300,000 house that’s a total loss because of a flood, the most you can recoup through the program is $250,000 to cover the structure itself.

For your personal possessions, the cap is $100,000 under the federal program.

If you already have insurance through the federal program, then you can buy “excess flood insurance” through a private carrier that would cover claims above the national limits. In essence, it’s a flood policy with a $250,000 deductible, Griffin says.

Note that flood insurance doesn’t cover living expenses if you have to relocate while your home is being repaired.

My Homeowners Policy Covers Floods

“Unfortunately, a lot of folks may be under the impression that their standard homeowners policy might cover flood damage,” Hackett says. But the standard policy doesn’t.

The typical home insurance policy doesn’t cover earthquakes or floods, so a homeowner wanting coverage for either of those disasters will need to pick up separate, specific coverage against those types of disasters.

If you want flood insurance, it pays to think ahead. There is a 30-day waiting period between when you buy the coverage and when it kicks in. When a hurricane is bearing down on your area, it’s too late to get a flood policy.

Water Damage Is Water Damage

When it comes to your insurance, not all water damage is the same.

If there’s a storm and your “roof comes off and water comes through, that would be covered under your homeowners policy,” Hackett says, “versus a flood situation where the riverbank overflows and you look out of the front of your house and you need a boat to get from point A to point B.”

Most consumers “have a pretty good understanding” of how to draw the line between storm damage and flood damage, he says.

Some homeowners policies offer an optional “water-backup endorsement” that covers damage from water backing up into your home from causes such as a broken sump pump.

Flood Maps Don’t Change

Flood plains (and flood plain maps) change and evolve. Just because you weren’t in a flood plain when you bought your home a few years ago doesn’t mean you’re not in one now.

There are a couple of ways you can find out about your flood risks.

- FloodSmart.gov: This site will allow you to put in your address and see if it’s in a flood plain, and give you information on risks, premiums and agents. But use it as one tool, not the final word on whether your home is in a flood plain.

- Your insurance agent: When it comes to researching whether your home is in a flood plain, you definitely want someone knowledgeable to research the question for you—and, you might want to get a second opinion from a different agent.

“Agents have different levels of sophistication with regard to this product,” says Griffin. “You get a different answer sometimes. So you make a couple of checks to make sure you’re protecting yourself.”

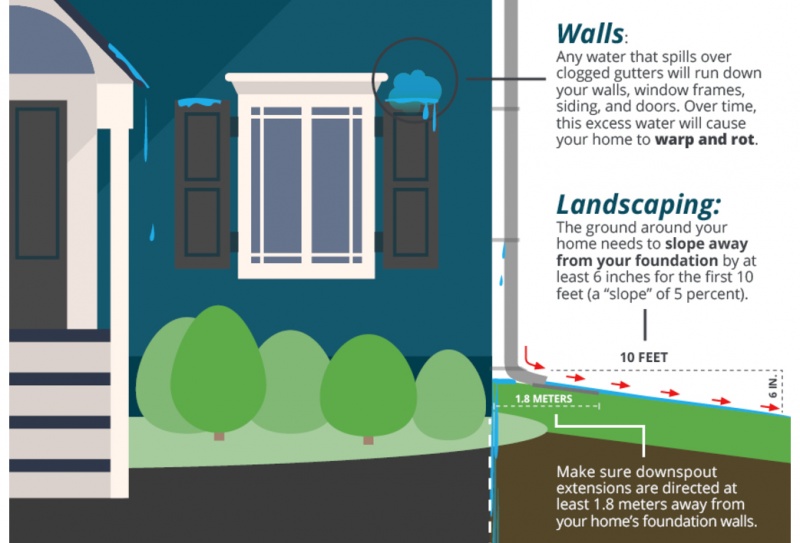

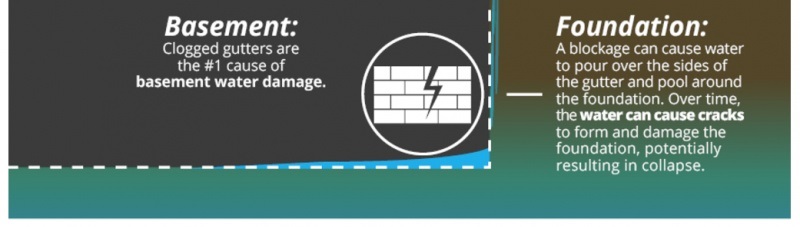

Don’t Let Clogged Gutters Wreak Havoc on Your Home

Deferred maintenance on your gutters can cost you dearly. It’s almost as bad as having no gutters!

As a homeowner, you undoubtedly understand just how important home maintenance is when it comes to preserving the life of your home. In fact, you probably spend a good chunk of time fixing problem areas and items both inside and outside your home.

But when was the last time you checked the gutters? While clogged gutters can wreak havoc on your home from top to bottom, maintaining your gutters and downspouts will work in your favor when it comes to avoiding conditions such as flooding, foundation damage, pest infestation, roof damage, warped/rotted window frames, siding and doors, and mold—all of which may ultimately undermine the integrity of your home.

The following infographic from Kings of Clean sheds light on the important role gutters play in the well-being of your home.

Source: RisMedia

How to Prepare Your Home Before Going on Vacation

Ahhhhh, that summer vacation is on your radar now…just a few loose ends to wrap up before you hit the road!

Your summer vacation is finally here! You’ve booked flights, reserved hotel rooms, and scoped out the best places to eat along the way, but have you prepared your home for your absence?

Nothing spoils a vacation like returning to smelly trash, sad houseplants, or an unexpected break-in. Whether you plan to be gone for a week or a month, there are a few simple steps you can take to get your home ready so you can relax and enjoy your time away.

Clean Up

Leave your home exactly as you’d like to find it when you return—like new!

- Empty your refrigerator of any perishable foods that will pass their enjoy-by dates while you are away, and toss open pantry items that will mold or go stale.

- Take out the trash and recycling. Don’t forget about smaller trash cans in bathrooms and utility rooms.

- Finish, fold, and put away laundry. You’ll likely have clothes to wash when you return, so get a jumpstart before you go.

- Wash your sheets and towels, and remake your beds. You’ll thank your past self when you come home to fresh linens in clean bedrooms and bathrooms.

- Wipe down counters, run your garbage disposal, sanitize toilets, and organize clutter.

Close Out

Reduce the possibility of surprise maintenance issues, which can be costly to fix, by keeping up with regular home repairs throughout the year.

- Perform routine inspections and weatherize. Make sure your heating and cooling systems, gas and water lines, and roof and windows are in good shape. Clean up your yard, mow the grass, and take care of any dead trees or overhanging limbs that could cause damage in severe weather.

- Unplug all small appliances. This will save power and eliminate the potential for things to short-circuit and cause significant electrical damage.

- Check your smoke detectors. Batteries die, parts wear out, and dust and other pollutants can impede alarm performance. Make sure your home is prepared in case of fire, and consider integrating your detectors into your home security system so the fire department is notified in an emergency.

- Turn off your water at the main shut-off valve to prevent damage in the case of a burst pipe or water heater malfunction. Consider installing a water and flood sensor, which detects moisture where it shouldn’t be and pushes notifications to your smartphone.

- Leave your closet doors ajar to prevent mold and musty smells from building up.

Secure

Protect your home and belongings from thieves. The highest percentage of burglaries occur during the summer months, and homes without security or alarm systems are up to 300 percent more likely to be broken into.

- Set up remote monitoring. You can have a security system professionally installed or start with a wireless security camera that you can view from your smartphone. If you have a security monitoring service, let them know that you are traveling.

- Collect spare keys. If you have house keys hiding under doormats or flower pots, bring them inside so prowlers don’t find them. Leave an extra set with a trusted neighbor or friend in case there’s an issue that needs to be addressed while you’re away.

- Hold your mail and newspapers. Nothing signals that you are out of town like an overflowing mailbox or stack of unread papers on your front porch. Placing a hold with USPS is as easy as completing an online form and will prevent identity thieves from targeting sensitive information found in bills and credit card statements.

- Take advantage of home automation. You can link everything from smart locks that you can triple-check via smartphone app to smart doorbell cameras that sense motion on your front porch and have two-way audio.

- Close blinds into rooms that contain expensive items, and set up smart light timers that mirror your regular habits when you’re home.

- Ask for help. Have a neighbor park in your driveway while you’re gone, and enlist a friend to water your plants and check up periodically on your property.

A little bit of preparation will go a long way when it comes to leaving your home clean and secure, and enjoying your vacation stress-free!

Source: RisMedia

11 Reasons Why Your Home Isn’t Selling

Your home is on the market and you really thought it would go into contract that first month, but it didn’t. Its not. No offers. Nada.

What’s up with that? Read on!

When you first put your house on the market, you might be hopeful for a quick sale—especially if you’ve put a lot of money into improving the house over the years and if the neighborhood is one that has historically attracted a lot of buyers. While you shouldn’t panic if the house doesn’t sell the moment you list it, you should begin to worry if the months start flying by without any real offers. If this is the case, here are 11 reasons why your house may not be selling.

1. You overvalued your property. If your house is overpriced, it’s simply not going to sell. Compare your property to similar properties that recently sold within your area to get a better idea of its true value. An experienced real estate agent can give you an accurate value of your home. Additionally, don’t make the mistake of tacking on the cost of any renovations you made. You can’t just assume that the cost of a renovation translates to added value.

2. Your listing is poor. If the listing of your home includes a poorly written description without any images, a lot of buyers are going to skip over it. Make sure you and your REALTOR® put an effort into creating a listing that attracts the attention of buyers. Make sure to add high quality photographs of both the interior and exterior of your home. Don’t forget to highlight unique features, as well.

3. You’re always present at showings. Let your agent handle your showings. Buyers don’t want to have the seller lurking over their shoulder during showings, especially during an open house. This puts unwanted pressure on the buyer, which will make them uncomfortable and likely chase them away.

4. You’re too attached. If you refuse to negotiate even a penny off your price, then there’s a good chance that you’ve become too attached to your home. If a part of you doesn’t want to sell it, or you think your house is the best house in the world, odds are you’re going to have a lot of difficulties coming to an agreement with a potential buyer.

5. You haven’t had your home professionally cleaned. A dirty house is going to leave a bad impression on buyers. Make sure you have a professional clean your carpeting and windows before you begin showing your house.

6. You haven’t staged your home. If you’ve already moved out, then don’t show an empty house. This makes it difficult for buyers to imagine living in it. Stage your house with furniture and decor to give buyers a better idea of how big every room is and how it can be used. You want the buyer to feel at home when they are taking the tour.

7. You kept up all of your personal decor. Buyers are going to feel uncomfortable touring your house if you keep all of your family portraits up. Take down your personal decor so that buyers can have an easier time imagining themselves living there.

8. Your home improvements are too personalized. You might think that the comic book mural you painted for your child’s room is absolutely incredible, but that doesn’t mean potential buyers will agree. If your home improvements are too personalized, it can scare off buyers who don’t want to pay for features they don’t want.

9. Your home is too cluttered. Even if your home is clean, clutter can still be an issue. For example, maybe you simply have too much furniture in one of your rooms. This can make the house feel smaller than it is.

10. Your home is in need of too many repairs. The more repairs that are needed, the less likely a buyer will want your house. Many buyers simply don’t want to deal with the cost or effort of doing repair work, even if it’s just a bunch of small repairs, such as tightening a handrail or replacing a broken tile.

11. You chose the wrong real estate agent. In our opinion, choosing the right real estate agent is simply the most important decision you make in selling your home. A good REALTOR® makes all the difference in selling your home within a reasonable time.

All these things can be fixed once you realize your mistake; however, the longer your property stays on the market, the less likely it will sell at listing price. One of the best ways to avoid making these common mistakes is by working with a professional real estate agent.

Source: RisMedia

9 Home Gadgets to Save Energy and Entertain

Who doesn’t love a great gadget?! Isn’t it interesting what sort of great ideas these companies come up with?

So you’re up for making your home truly state-of-the-art? I’ve got a great list for you. Here are nine gadgets to be on the lookout for:

Moen’s U lets you customize the perfect shower before ever stepping in with just a few taps on your smartphone.

Smart and Blue’s Hydrao smart showerheads let you instantly control your water consumption and energy needed to heat it by lighting up the water spray with different colors depending on the amount of water used—and it’s powered by the shower’s natural water-flow.

Luke Roberts Smart Light – This LED pendant lamp, from Austrian startup Luke Roberts, lets you place light in any direction, illuminating only certain areas of a room through simple gestures on your phone.

Kuri – Created by Mayfield Robotics, this app uses a camera to check on pets, kids, or guests when you’re away. It sets reminders, uses Wi-Fi to connect to things like weather reports, and works with IFTTT to control some connected devices, according to CNET.com.

Hello Egg – From RnD64, this works with the Eggspert web and mobile application to fully automate planning weekly meals, supervising the pantry, organizing shopping lists, and even ordering grocery delivery. Hello Egg also projects voice-navigated video recipes and answers cooking-related questions with a connected 24/7 support team of cooking experts.

CUJO creates a guarded firewall gateway between your devices and their connection to the internet by analyzing for malicious intent, whether it’s coming in from the internet, going out to the internet, or making moves across your network.

AirTV is the only major streaming platform that integrates local over-the-air (OTA) programming with your streaming services. Just add an AirTV Adapter and an OTA antenna to get local channels in HD, without a monthly cable bill.

Sony A1E – Unlike most TV speakers, sound comes to you from the entire screen, immersing you in a new entertainment experience—if there can be such a thing!

LG W7 – Capturing Best of the Best recognition at CES 2017, the W7’s picture-on-wall design allows the television to lay virtually flat so it seems blend with the wall and disappear.

Source: RisMedia

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link